The notion of doing a competitive analysis before launching a content or product campaign isn’t particularly novel. But too few marketers have updated their approaches for the realities of today’s content overload, and even fewer produce competitive analyses with comprehensive strategic recommendations. It’s easy to understand why—the growing mix of formats and channels to explore, the amount of data and audience insights to analyze, and the pace of business trends can be daunting. But the results, then, are often half-baked scans of the market or content readouts that don’t actually elevate campaign strategy, messaging, and content development.

So how can companies get more from their competitive analyses and thus more from their campaign and content investments? We suggest three actions.

Go beyond the content

Yes, content is foundational, and any competitive review will involve evaluating the quality, distinctiveness, and efficacy of marketing collateral, publications and other thought leadership, videos, podcasts, webinars, and social content. But analyzing content in isolation isn’t enough; creating deeper value from competitive analysis requires synthesizing a range of inputs:

- Geography. For instance, marketers should layer in geography to understand regional nuances, where competitors are prioritizing their efforts, how messaging or content reflects a regional perspective, and how competitors are going to market in specific areas.

- Audience insights and personas. Who are your competitors trying to reach, and are they reaching them successfully? A thorough review of competitive activity reveals the varying needs or challenges of different audience segments, how well competitors are articulating those challenges and solutions, and how targeted their messaging is. Are your competitors going after a niche audience—say, the HR or finance buyer—or are they more broadly targeting the C-suite? Does this differ by company size? Does their messaging align with the needs of the audience? If not, there could still be a good amount of white space, even on crowded topics.

- Market research and the overall business conversation and trends. This external lens on today’s business realities is a necessity. It helps reveal how sophisticated competitors are, how nuanced their perspectives are, and how critical their thinking is. Take, for instance, the boom in content related to diversity, equity, and inclusion. Are competitors glossing over problematic data points—such as the number of women considering large-scale career changes as a result of the pandemic—in favor of platitudes or feel-good content?

- Other brand-building measures. Consider, too, the various ways companies lay claim to a given topic. Assessing the events they participate in or sponsor, their partnerships, and any of their deeper investments—such as experiential facilities for technology, innovation, or design—helps better clarify not only what they’re doing now but where they’re headed, as well as identify where the bar is set for market share on a given topic. Leadership presence can also indicate how invested they are in a given topic. If senior leaders are speaking on diversity or smart manufacturing, then that’s where the company is focused. And going deeper on certain strategies, like partnerships, helps outline which ones build credibility versus simply garnering exposure.

- Additional data points. In addition to an expert evaluation of content quality and distinctiveness, quantitative data—for instance, on social listening, keyword share, or marketplace mentions—can help measure the penetration and success of campaigns.

Establish the best-in-breed benchmarks

A successful competitive analysis reveals what good looks like and how to get there. In our experience, several benchmarks can help ensure your content and campaigns clear the bar:

- Overarching quality and campaign metrics. We measure content with an eye on analytical rigor, depth of prescription, freshness and provocativeness of the insights or messages, and quality of the presentation. But on top of that, we look at the campaign level: How well connected are pieces of content? Is there a well-defined vision? Is there a good mix of formats to fill a variety of channels in an intentional way? For instance, if a competitor has taken the same white paper and blasted it across all of their channels without tailoring the content to the user intent on that channel, they’re likely not thinking about campaign strategy at a higher level.

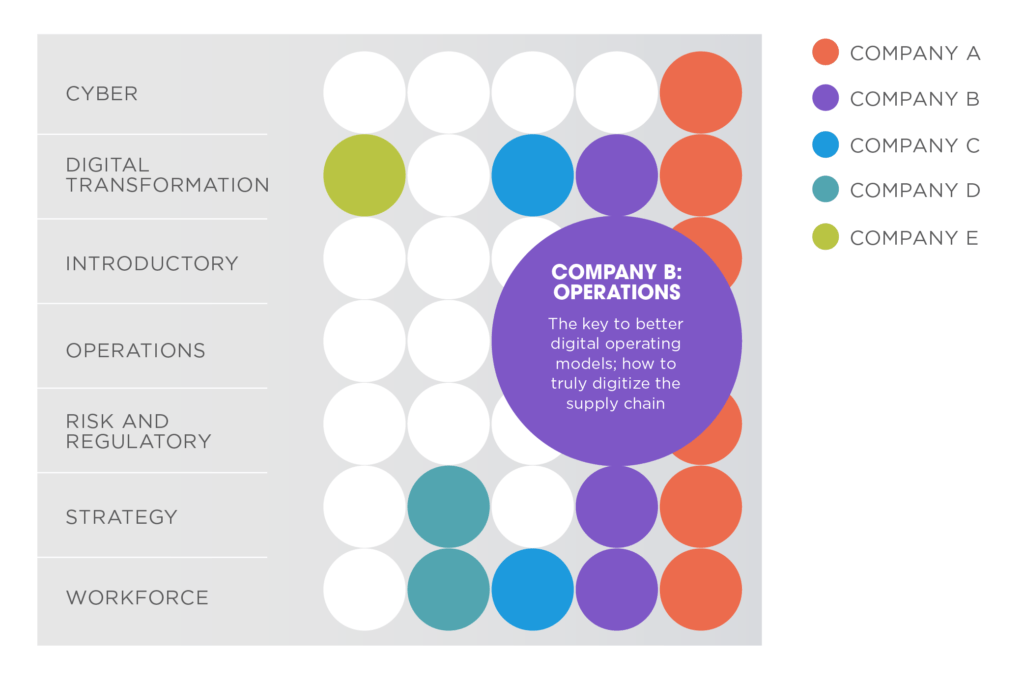

- Distinctive messages and positioning. A message matrix can help visualize which competitors have truly distinctive messaging or perspectives and which are failing to advance the conversation on a topic or challenge (exhibit). A matrix can also be helpful when it comes to distinctive positioning: How have competitors sought to position themselves in the market and how do they want to be perceived by customers? Are they a premium brand or a change agent? Are they competing on value or price? Ultimately, a matrix can help identify where the white space or niche opportunities are.

- Proof of concept and case studies. Whether your campaign promotes a product, service, or idea, having meaningful results to point to is critical. You can understand how competitive your value proposition and proof points are—and how best to communicate them to your audience—by analyzing competitors’ approaches and whether they’re providing compelling data points and proof of their value positions and benefits.

Exhibit: A sample message matrix reveals competitive messaging in various areas.

End with clear solutions and recommendations

This is often the missing link. A competitive analysis can reveal opportunities or demonstrate that competitors have captured significant market share—both of which require a solution. Below are some examples of recommendations that may come out of the findings:

- Positioning and messaging. The analysis should start the conversation on how your brand should be perceived and why, including the “reasons to buy.” In addition, the recommendations should detail what messaging supports the brand position and how to make it stand out. For instance, the analysis might highlight that many companies’ key messages are focused inward rather than on the audience’s needs and challenges. Therefore, flipping the script with more audience-first messaging can go a long way.

- Integrated campaign ideas. What overarching campaign topics, titles, and concepts would work best to compete at a high level? If every competitor is building a campaign around customer experience or “the new normal,” what ideas will cut through the clutter? Which marketing channels and formats are table stakes, and which are oversaturated and not worth the investment? You may also identify partnership and event opportunities that can not only amplify campaign efforts but also support overall brand building.

- Topic angles to fill white space. Often, the competitive analysis highlights topics or themes that competitors haven’t addressed in meaningful ways but that still have value for the audience. A good analysis details what those are, drawing on audience insights and a handful of angles to consider.

- Geography- or persona-specific insights. Mapping out these details can make campaigns and content more targeted and effective—particularly when a certain competitor is investing heavily in a region or audience segment.

***

Competitive analyses require an investment of time and resources, so companies should make sure they’re getting the most out of them. While the research and inputs can be exhaustive, the takeaways should focus on what matters most—and, critically, what to do about it.

Leave a Reply

You must be logged in to post a comment.